- CHZ is a blockchain platform for entertainment and sports purposes. It is developed by Maltese Sports Company.

- CHZ was launched by Alexandre Dreyfus on 1st October 2018. In July 2018 token raised $65 million led by Binance.

- It allows users to vote on a variety of minor decisions, such as celebration songs, kit designing etc.

CHILIZ token was expected to get a boost during the 2022 Fifa World Cup but instead it was decreased by 50% during the World Cup.

Technical indicator is not providing any bullish signs. The RSI is below 50 and has not given any bullish sign.

The long term investors are looking to sell CHZ due to the continuation of bearish trend in the token.

CHZ has been only attracting a few new users which is the main reason for the fall in the price. Let’s analyse the price of Chiliz.

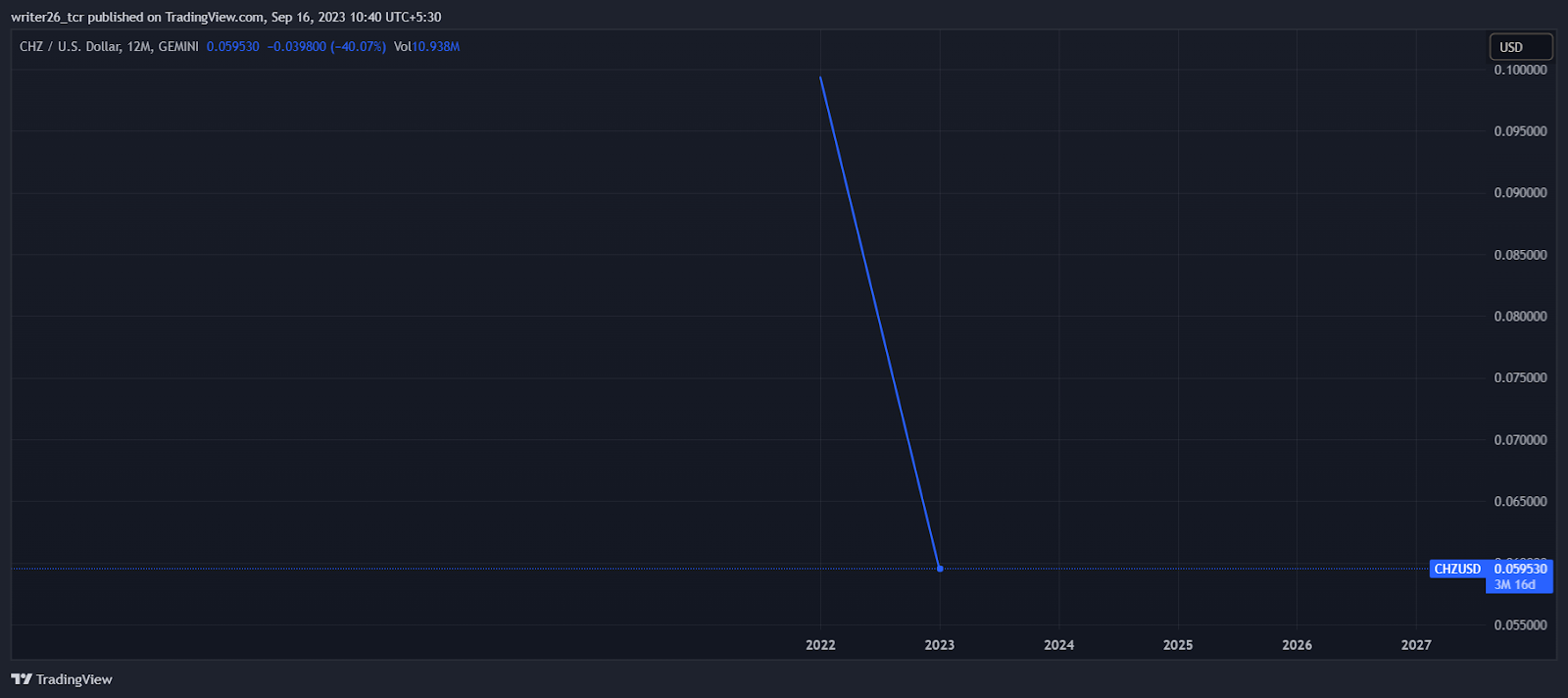

Technical Analysis of CHZ(Yearly)

Source: GEMINI: CHZUSD by Trading View

CHZ overall grew by 245.89% which is good but the chart is showing something else.

There were some other reasons also for the fall in the price of every cryptocurrency in the market.

The token is falling in a straight line and the all-time high was $0.274. It was down by 70.48% in the yearly time frame.

Technical Analysis of CHZ(Monthly)

Source: GEMINI: CHZUSD by Trading View

In the monthly time frame, the token is in downtrend. It might continue its downward movement in the future.

By making another resistance on the trend line. The breakout or the recovery is not seen by experts from 2023. It was down by 13.91% which is fluctuating every second.

The Chiliz age consumption spiked from 5.97 billion to 43.53 billion which means long term investors are selling the coins in large amounts.

Technical Analysis of CHZ(Weekly)

Source: GEMINI: CHZUSD by Trading View

In both monthly and weekly time frames, the chart is in the down direction only. According to forecast, the price may reach $0.062 by 21st September 2023.

It is predicted to be up by 3.37% and the current market sentiments are bearish in nature. It was up by 1.42% in last 7 days.

F&I Index(Fear & Greed Index) is showing 43(Fear). In the last 30 days, 11/30 days were green which is around 37%.

The price volatility over the last 30 days was around 4.75%. The price prediction sentiments are currently neutral.

Technical Analysis of CHZ (Daily)

Source: GEMINI: CHZUSD by Trading View

In the daily time frame, the coin has already broken a support level and might move up by taking support from the bottom line.

Recently, it made multiple points on that line so the chances of getting a good up move can be expected in the future.

The coin is up by 3.42% in the daily time frame. There are two strong resistance levels also but the coin is unable to reach till that level.

Summary

Through the technical analysis we can conclude that the coin is not performing well in the monthly, weekly and daily time frame.

In the daily time frame, it is in a downward direction. In the monthly time frame, according to candlestick it may move lower in the future.

Crypto investors should have proper knowledge about the cryptocurrency market.

Technical levels

Resistance Level- $0.1606

Support Level- $0.0564

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or any other advice. Investing in or trading stocks comes with the risk of financial loss.